From the doom loop to an economy for work not wealth

The imperative to tax wealth should instead be set as part of a wider diagnosis and remedy for these dislocations on a long view. Matthew Klein and Michael Pettis (2020) are among a handful of economists identifying opposed interests:32

“conflict mainly between bankers and owners of financial wealth on one side and ordinary households on the other – between the very rich and everyone else” (p. 221). Their ‘New Macroeconomics’ appeals to underconsumption/over production (UCOP) analysis attributed to the British Liberal economist J. A. Hobson (1858-1940), though the thinking overlaps closely with J. M. Keynes’s General Theory.

On this view, excessive imbalance towards wealth from labour distorts economic activity through a dislocation between aggregate production and aggregate purchasing power. On the one hand too low wages put goods and services out of the reach of workers. On the other hand the massive resources of the wealthy do not compensate because they are relatively less interested in goods and services (“you can only throw so many million-dollar birthday parties”, as Matthew Klein put it). 33

Consumption therefore falls short and overproduction is the result. Moreover excess wealth is translated into assets, as high returns and capital gains are sought. Speculative in nature, these activities distort the economic landscape and potentially further aggravate excess production.

The logic also leads to the vital conclusion that underconsumption and overproduction are relative conceptions: production is only excessive relative to deficient purchasing power and pay. It therefore follows that a better balance between labour and capital will permit higher production in an absolute sense. 34

The analysis has always appealed to the left, above all motivating the 1945 Labour Manifesto:

Over-production is not the cause of depression and unemployment; it is under-consumption that is responsible. It is doubtful whether we have ever, except in war, used the whole of our productive capacity.

Immediately certain implications follow that invert the conclusions of present debate:

- To the extent that taxation is part of the reorientation to labour from wealth, rather than set in the context of the public finances as a zero-sum game, set in a macro context the outcome will be greater than the sum of the parts.

- The global financial crisis and subsequent conditions have been wrongly judged as the public living beyond the means of the economy, instead the economy has operated beyond the means of the public. Supply is excessive given deficient demand, not the other way round.

- The theory reenforces the empirical judgement that there is vast underutilised potential that can be deployed through current as well as capital expenditures.

On a longer view redistributive taxation and public expenditure are only elements of a wider system change, which follow in part from Keynes’s theoretical analysis and his related practical contributions, and likewise the policy action of left and progressive governments in the wake of the great depression and into the peace after the Second World War.

The General Theory allows a clearer sight of the differences between the episodes on either side of 1979. For, rather than simply resolving crisis, Keynes was concerned to devise policies to prevent crisis and ensure economic resources were fully utilised. The focal point of his analysis and much of his practical work was securing a permanent reduction in the long term rate of interest. 35

On the broadest view, the implications can be stated as follows:

- First, his analysis shows the returns to wealth/capital and labour are set according to social factors and so power relations.36

In contrast, orthodox economics claims these returns are set according to natural forces unrelated to power, and that follow a predetermined (largely by technological advance) trajectory for the economy. Impervious to change, society must simply endure the consequent conditions. Writing after the Autumn Statement, Paul Johnson of the Institute for Fiscal Studies offered only: “We are in for a long, hard, unpleasant journey”. Keynes famously discussed the factors behind such defeatism, for example observing: “That [orthodox] teaching, translated into practice, was austere and often unpalatable, lent it virtue”.37

- Second, setting the balance towards labour rather than wealth/capital would permit economies to unlock unused potential – not least previously unemployed workers – and permit much greater prosperity and stability.

His account resonated with Keir Hardie’s judgement, and provided the means for its resolution: “a system which robs the nation of its wealth, acts as a drag on industry, and cheats labour of its own” (2015 [1907], p. 43). Viewed on these broad terms the General Theory leads to a (basically binary) reset of the economic system and a level shift in economic outcomes. In very concise terms the theory suggests a low return to wealth coupled with a high return to labour would set in motion a virtuous cycle of consumption and investment (see Annex 1 for diagramatic version).

Later accounts of his theory emphasised in particular fiscal policy to resolve crisis, and more generally demand management to support the economy – these not only set his account on too narrow terrain but also undermine the substance of his work. The ‘unpleasant journey’ could be just as easily avoided, though the powerful and wealthy would lose out.

- Third, the means to rebalancing power relations was to reset the economic relations between countries.

Keynes’s steer in the final chapter of his book remains fundamental:

… if nations can learn to provide themselves with full employment by their domestic policy … there need be no important economic forces calculated to set the interest of one country against that of its neighbours … International trade would cease to be what it is, namely, a desperate expedient to maintain employment at home by forcing sales on foreign markets and restricting purchases, which, if successful, will merely shift the problem of unemployment to the neighbour which is worsted in the struggle, but a willing and unimpeded exchange of goods and services in conditions of mutual advantage. (CW VII, p. 382)38

His policies on international and domestic levels were complementary. He aimed at a international monetary architecture that would permit countries the autonomy to secure high domestic demand and full employment. This meant institutional change was critical on both domains, broadly meaning a good deal of public rather than private authority over monetary and financial mechanisms (e.g. clearing union for international exchange, capital control, nationalised central banks and finance ministry lead on debt management). The relevance of any such mechanisms today is not a matter of fact, but should be a matter for debate. He gave too little emphasis to parallel considerations on labour, but the Labour Party were clear sighted on the role of the I.L.O.: “It must become a powerful and vital instrument, not only for international understanding among the workers of all lands, but for raising standards of life throughout the world ...” (NEC, 1945, p. 6).40

While still greatly compromised, for 30 years after the Second World War the global economy was operated more in line with this thinking and so more according to the interest of labour than ever before. From 1979 the lessons were wholly disregarded, and the economy has been operated in the interests of wealth – perhaps to an extreme extent.

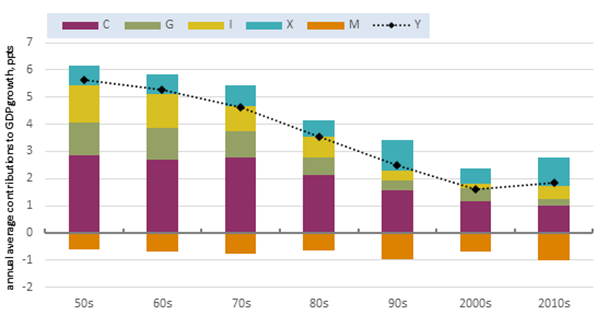

The contrasting performance is most obviously evident on the GDP expenditure measure decomposition of aggregate demand, which also allows outcomes to be set against the relevant policies. Figure 6 is a composite measure across G7 countries of annual average GDP growth by decade, showing the contributions of household consumption (C), investment (I) and government demand (G) – and then overseas demand through exports (X) offset by imports (M).

Figure 7: G7 average GDP decade growth

- 32 Others include Robert Reich (e.g. ‘The problem isn’t ‘inflation’. It’s that most Americans aren’t paid enough’, Guardian, 13 Aug. 2021: https://www.theguardian.com/commentisfree/2021/aug/13/joe-biden-spending-plans-inflation-debt-fears-misplaced) and J. W. Mason (e.g. ‘A New Macroeconomics’, Brave New Europe, 7 Jul. 2021: https://braveneweurope.com/j-w-mason-a-new-macroeconomics). Above all President Elect Biden called 'Time to Reward Work, Not Wealth', 16 November 2020.

- 33 At a presentation of his work on 6 April 2021 to the TUC conference on labour internationalism: https://www.youtube.com/watch?v=0JZQvReBg7Y

- 34 The labour party complained in their 1945 manifesto “Over-production is not the cause of depression and unemployment; it is under-consumption that is responsible”.

- 35 While Keynes is normally associated only with fiscal policy, this is not how he saw it (Tily, 2010). In the House of Lords defending the Bretton Woods Agreement he appealed basically to his life’s work as follows: “My Lords, the experience of the years before the war has led most of us, though some of us late in the day, to certain firm conclusions … We are determined that, in future, the external value of sterling shall conform to its internal value as set by our own domestic policies, and not the other way round. Secondly, we intend to retain control of our domestic rate of interest, so that we can keep it as low as suits our own purposes, without interference from the ebb and flow of international capital movements or flights of hot money. Thirdly, whilst we intend to prevent inflation at home, we will not accept deflation at the dictate of influences from outside. In other words, we abjure the instruments of Bank rate and credit contraction operating through the increase of unemployment as a means of forcing our domestic economy into line with external factors … I hope your Lordships will trust me not to have turned my back on all I have fought for. To establish those three principles which I have just stated has been my main task for the last twenty years” (23 May 1944, CW XXVI, p.16, my emphasis).

- 36 Tily (forthcoming) – available on request.

- 37 General Theory, Chapter 3 section 3.

- 38 In 1977 Richard Kahn observed “The world still has to accept this simple lesson taught by Keynes”.

- 40 Today the ILO describes its role as follows: “bringing together governments, employers and workers of 187 member States, to set labour standards, develop policies and devise programmes promoting decent work for all women and men”. https://www.ilo.org/global/about-the-ilo/lang--en/index.htm

Above all outcomes are dictated by first the presence of strong domestic demand and then by its absence. And likewise the contrast between the two episodes is evident on each component of domestic demand. Over the 30 years after the Second World War, known as the golden age in the UK and ‘les trente glorieuses’ in France:

- lower interest rates (and capital control) permitted higher fixed capital investment; 40

- higher government expenditure was in part supported by lower interest rates, but more generally by the wider philosophical shift that permitted public as well as private activity to be productive;

- the consequent higher output and also greater protections for unions and workers twice advantaged real pay and so consumer demand.

After 1979 the above doctrine was rejected across the board, and the consequence was severe negative repercussions across investment, government and consumer demand alike. External impetus became greatly more important, though not materially to the advantage of individual economies with exports broadly offset by imports. Moreover ahead of 1979 the growth in export volumes was still higher than after 1979, just less important in relative terms. 41

Setting theory and outcomes on this broader view serves too as a reminder that Keynes’s theory was not exclusively about government spending in opposition to the market. Despite his theory meaning a different approach to the state, his fundamental concern was to show how the market could be made to work better and that collapse wasn’t endemic to market systems. The contemporaneous tendency to autocracy was likely uppermost in his mind. Crisis was instead endemic when the system is oriented at the interest of the wealthy, i.e. endemic to a rentier economy (Standing, 2016 & Stratford, 2020). 42

- 40 Hugh Dalton summarised the aim of his cheap money policy: “to save public expenditure on interest, to improve the distribution of income, to encourage investment and to make sure of full employment” (Dalton, 1954 [1922], p. 235).

- 41 ‘Globalisation’s strength is through domestic demand that’s why it’s in crisis’, Geoff Tily, 13 Jan. 2017: https://touchstoneblog.org.uk/2017/01/globalisations-strength-is-through-domestic-demand-thats-why-its-in-crisis/

- 42 The Labour Party of the 1940s went as far as “blame for unemployment lies much more with finance than with industry. Mass unemployment is never the fault of workers; often it is not the fault of the employers” (NEC, 1945).

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox