Conservative policies mean UK has had worst inflation and growth outcomes in the G7

On economic outcomes, today the TUC released analysis showing:

- The UK economy did worse than all G7 economies on both inflation and growth.

- A majority of all advanced economies (19 of 36) did better on both measures than the UK.

The analysis focuses on the two years of the cost-of-living crisis from the end of 2021 – when the Bank of England first raised interest rates – to the end of 2023 – the last quarter with data for all countries.

The outcomes once again show conservative government policies as seriously wrongheaded. While the coming monthly figures are likely to show inflation back at target, across the two years the UK has paid a much higher price than other countries in terms of growth.

In fact, country results overall suggest that countries giving priority to growth were rewarded with lower inflation. Rishi Sunak’s logic may have been back to front: he failed on growth because he put too much emphasis on inflation.

Over the two years to the fourth quarter of 2023, UK prices rose by 14.2 per cent (on the CPIH measure) and UK growth was 0.4 per cent. This poor performance is in contrast to other countries:

- Overall G7 growth was 2.7 per cent with inflation of 10.7 per cent.

- Of the G7 economies, the US performed best on GDP with growth of 3.8 per cent, and third best on inflation at 10.6 per cent.

- Even the euro area saw growth of 2.0 per cent and inflation of 13 per cent.

- Only five countries (Chile, Czechia, Estonia, Lithuania and Sweden) have done worse than the UK on both inflation and GDP. The worst of these was Estonia where GDP fell by 5.6 per cent and prices rose by 25.6 per cent.

- Nine countries have done better than the UK on GDP but worse on inflation, and three have done worse than the UK on GDP but better on inflation.

The full country figures are shown at the end of this commentary.

The Prime Minister and his chancellor have ignored the experience of those countries who approached the cost-of-living crisis very differently. Above all they disregarded the expansionary policies of the US under the Inflation Reduction Act.

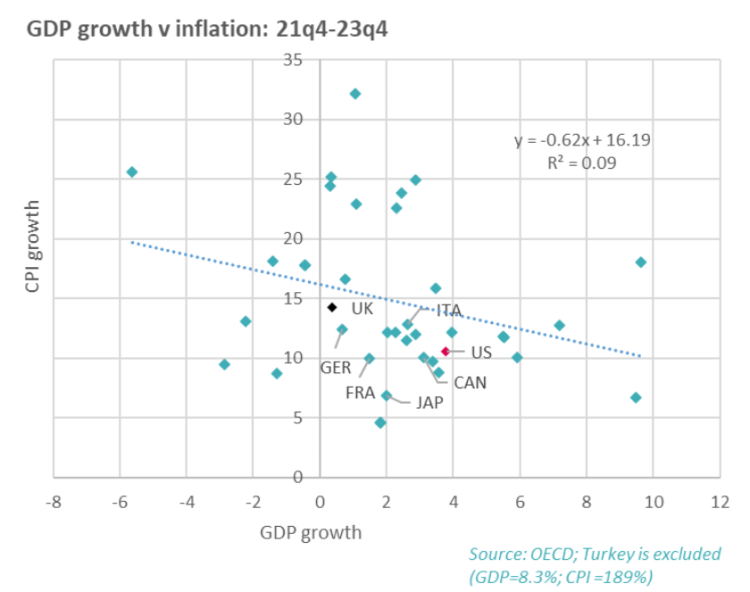

Our analysis of country experience overall suggests on average those countries that took a more expansionary approach not only did better on growth, but did better on inflation as well. The scatter plot below shows the highest inflation figures concentrated around lower growth and the higher growth figures more concentrated around lower inflation. Plainly the relation is not exact, but it is strikingly opposed to the conventional logic (note: the chart and analysis omits Turkey).

The analysis reenforces the view that inflation was a supply-side phenomenon, and that demand was (and remains) deficient rather than excessive as policymakers insisted (and many still insist).

As a result, countries with stronger demand benefitted from stronger growth, and did not pay any price in terms of higher inflation. Indeed, the evidence suggests higher inflation might be the price for not doing enough on demand and growth. (Most obviously, in a financially constrained environment, stronger demand and so stronger sales may mean firms feel less pressure to increase prices and may more easily be able to meet pay claims.)

Rather than trying to seek kudos for actions taken by the Bank of England, Rishi Sunak should have been seeking better to protect the economy in the face of higher interest rates. But instead he and Jeremy Hunt have reverted to austerity thinking, with the Treasury writing in their Budget document: “This gradual withdrawal of fiscal support for demand is helping the MPC to bring inflation sustainably back to target” (Box 1.C).

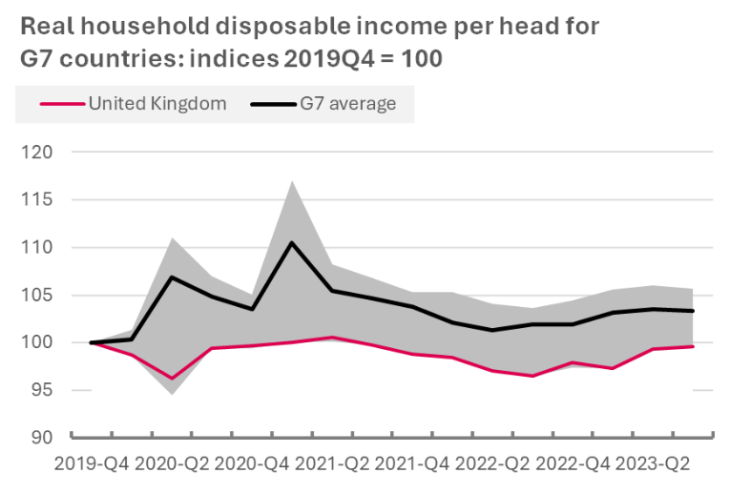

Deficient pay rises for public sector workers, restraint on public sector budgets overall, and backtracking on public investment – once more – have proven counterproductive. Previous TUC analysis showed UK living standards falling against a rise in all other G7 economies (and the chart below shows the UK remaining firmly at the bottom of G7 countries since 2019 on household incomes). Our Budget submission showed UK household consumption growth third from bottom of the league of all advanced economies.

The same point about household consumption was made this week in the Financial Times, with charts credited to the LSE’s Silvana Tenreyro (formerly of the Monetary Policy Committee). The author of the article (which likely is behind a paywall), Chris Giles, writes of a “temporary lack of effective demand” and urges “Europe does need to get private consumption up”. His charts suggest the position for the UK is even worse. And on the UK, we note that while the GDP figures improved, household consumption is still near stagnant: with growth into 24Q1 of only 0.2 per cent following a decline into 23Q4 of 0.1 per cent in 23Q4.

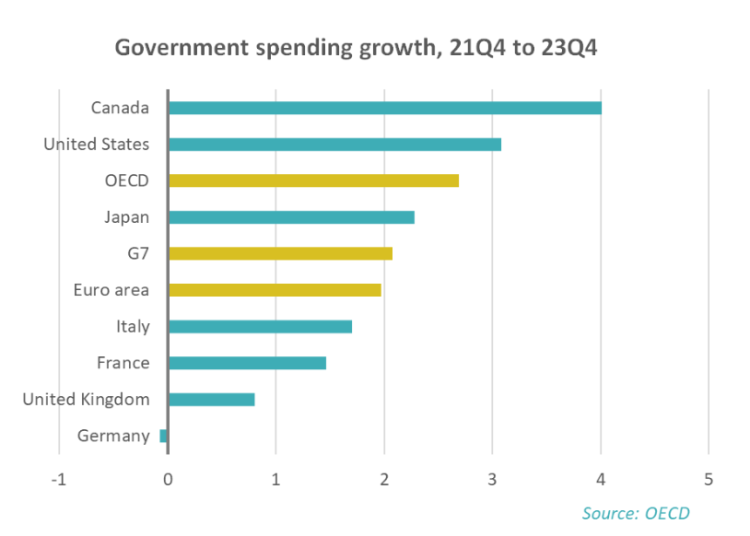

Beyond household demand there is government demand. Had the Conservatives taken the lead from President Biden’s Inflation Reduction Act, the UK might have enjoyed a significantly higher growth rate . National accounting information (on the chart below) shows governments doing more in all other G7 countries except Germany, and likewise across various country groupings (over 21Q4 to 23Q4).

Other countries have seemingly learned from past errors, but in the UK the Conservatives have refused to do so and the doom loop does not end.

Anex: All OECD country results

|

21Q4-23Q4: |

Growth |

Inflation |

|

United Kingdom |

0.4 |

14.2 |

|

Higher growth and lower inflation |

||

|

Growth |

Inflation |

|

|

Germany |

0.7 |

12.4 |

|

France |

1.5 |

10.0 |

|

Switzerland |

1.8 |

4.6 |

|

Euro area |

2.0 |

13.0 |

|

Japan |

2.00 |

6.8 |

|

New Zealand |

2.0 |

12.2 |

|

Netherlands |

2.3 |

12.1 |

|

Norway |

2.6 |

11.5 |

|

Italy |

2.6 |

12.8 |

|

G7 |

2.7 |

10.7 |

|

Belgium |

2.9 |

12.0 |

|

Canada |

3.1 |

10.1 |

|

Denmark |

3.4 |

9.7 |

|

Korea |

3.6 |

8.8 |

|

United States |

3.8 |

10.6 |

|

Australia |

4.0 |

12.2 |

|

Greece |

5.5 |

11.9 |

|

Portugal |

5.5 |

11.7 |

|

Spain |

5.9 |

10.1 |

|

Mexico |

7.2 |

12.8 |

|

Costa Rica |

9.5 |

6.7 |

|

Lower growth and higher inflation |

||

|

Growth |

Inflation |

|

|

Estonia |

-5.6 |

25.6 |

|

Chile |

-1.42 |

18.2 |

|

Sweden |

-0.4 |

17.7 |

|

Czechia |

0.3 |

24.4 |

|

Lithuania |

0.3 |

25.2 |

|

Lower growth and lower inflation |

||

|

Growth |

Inflation |

|

|

Luxembourg |

-2.9 |

9.5 |

|

Finland |

-2.2 |

13.1 |

|

Israel |

-1.3 |

8.7 |

|

Higher growth, higher inflation |

||

|

Growth |

Inflation |

|

|

Austria |

0.8 |

16.6 |

|

Hungary |

1.1 |

32.2 |

|

Latvia |

1.1 |

23.0 |

|

Slovak Republic |

2.3 |

22.6 |

|

Colombia |

2.4 |

23.8 |

|

Poland |

2.9 |

24.9 |

|

Slovenia |

3.5 |

15.9 |

|

Turkey |

8.3 |

188.6 |

|

Iceland |

9.6 |

18.1 |

Stay Updated

Want to hear about our latest news and blogs?

Sign up now to get it straight to your inbox